Golfsmith International Holdings LP (together with its subsidiaries, the “Company”) announce that yesterday (15th September) the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) granted various forms of relief requested with respect to the U.S.-based business of Golfsmith International Holdings, Inc. (together with its subsidiaries, “Golfsmith”), in connection with its voluntary Chapter 11 restructuring.

Golfsmith International Holdings LP (together with its subsidiaries, the “Company”) announce that yesterday (15th September) the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) granted various forms of relief requested with respect to the U.S.-based business of Golfsmith International Holdings, Inc. (together with its subsidiaries, “Golfsmith”), in connection with its voluntary Chapter 11 restructuring.

On 14th September, the Ontario Superior Court of Justice (Commercial List) (the “CCAA Court”) approved similar relief in the creditor protection proceedings of the Company’s Canada-based business (“Golf Town”) under Canada’s Companies’ Creditors Arrangement Act (the “CCAA”). Golf Town has entered into a definitive purchase agreement for the sale of substantially all of the assets of the Golf Town business to an entity controlled by Fairfax Financial Holdings Ltd. and certain investment funds managed by a division of CI Investments Inc., and intends to implement the transaction in connection with the CCAA proceedings.

On 14th September, the Ontario Superior Court of Justice (Commercial List) (the “CCAA Court”) approved similar relief in the creditor protection proceedings of the Company’s Canada-based business (“Golf Town”) under Canada’s Companies’ Creditors Arrangement Act (the “CCAA”). Golf Town has entered into a definitive purchase agreement for the sale of substantially all of the assets of the Golf Town business to an entity controlled by Fairfax Financial Holdings Ltd. and certain investment funds managed by a division of CI Investments Inc., and intends to implement the transaction in connection with the CCAA proceedings.

The orders issued by the Bankruptcy Court and the CCAA Court will help the Company continue its business in the normal course while the Company works to achieve long-term financial stability through the implementation of various transactions aimed at maximizing value for its stakeholders.

Importantly, the Bankruptcy Court and CCAA Court granted the Company approval to access up to $135 million in debtor-in-possession (“DIP”) financing, which will be used to support the businesses during the court-supervised process and allow the Company to pay its vendors in full under normal terms on a go-forward basis.

The Bankruptcy Court and CCAA Court also approved motions giving the Company the authority to, among other things, pay employee wages and benefits without interruption, honor gift cards and customer deposits, and continue its current cash management system in the ordinary course. The Company fully expects that its day-to-day operations will continue without interruption throughout the restructuring process.

The Bankruptcy Court and CCAA Court also approved motions giving the Company the authority to, among other things, pay employee wages and benefits without interruption, honor gift cards and customer deposits, and continue its current cash management system in the ordinary course. The Company fully expects that its day-to-day operations will continue without interruption throughout the restructuring process.

“The Bankruptcy Court and CCAA Court’s approval of the relief requested by the Company is another positive step forward in our efforts to restructure our businesses, and to continue operations in the ordinary course for the benefit of a broad range of stakeholders, including customers, employees, and vendors,” said David Roussy, Chief Executive Officer of the Company. “I would like to thank all of our employees, vendors and customers for their continued dedication and loyalty to our Company as we continue working to complete transactions that will strengthen the long-term viability of Golfsmith and Golf Town.”

Additional information about the Company’s reorganization, including court filings, is available at websites administered by the claims and noticing agent in Golfsmith’s Chapter 11 proceeding (https://cases.primeclerk.com/golfsmith) and by the court-appointed Monitor in Golf Town’s CCAA proceeding (http://cfcanada.fticonsulting.com/GolfTown).

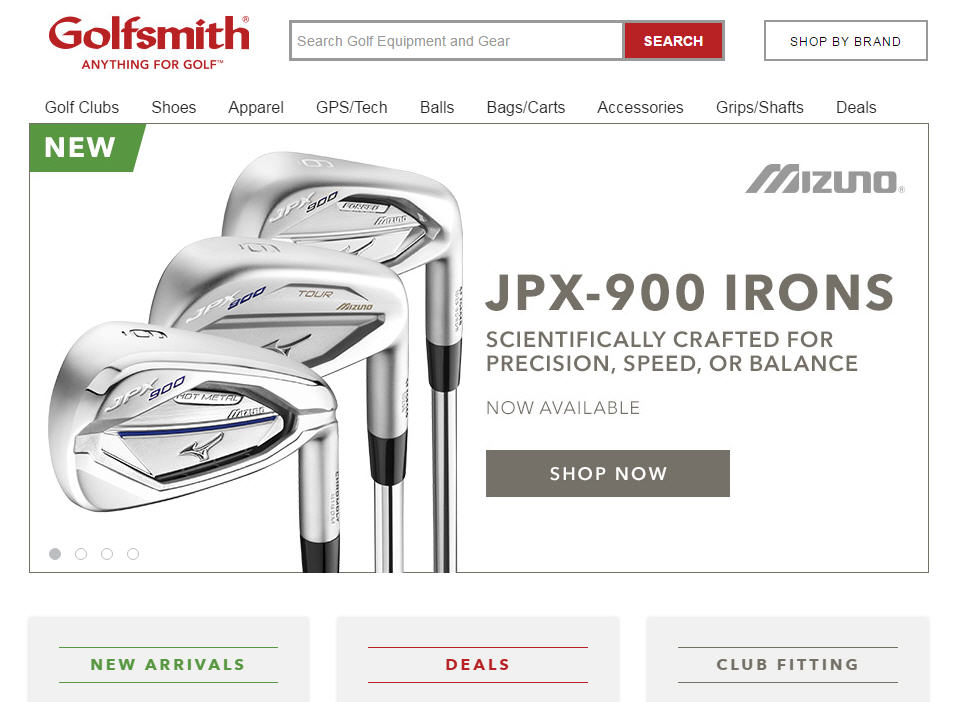

About Golfsmith and Golf Town

The Company, headquartered in Austin, Texas, is the largest specialty golf retailer in the world. The Company has 109 stores in the United States operating under the Golfsmith banner and 55 stores in Canada operating under the Golf Town banner. The Company also offers convenient, 24/7 shopping at www.golfsmith.com and www.golftown.com