(This article first appeared in NGF Dashboard and is republished here with the permission of National Golf Foundation www.ngf.org)

(This article first appeared in NGF Dashboard and is republished here with the permission of National Golf Foundation www.ngf.org)

3rd-party tee time sellers have been a polarizing subject in the golf industry since their emergence almost a decade ago. Concerns over price integrity, customer ownership and divided loyalties have caused some consternation among course owners and operators. However, partnering with services such as GolfNow.com and TeeOff.com offers benefits of additional marketing power, enhanced awareness and direct revenue that are difficult to dismiss.

A recent NGF survey revealed certain attitudes and behaviors among Core Golfers (as represented by the proprietary NGF research panel) that might have been less obvious or previously de-emphasized. Golfers told us they are utilizing tee time resellers at a growing pace, and, on average, reported playing more rounds and trying new courses as a result of the services.

Nearly one-third of core golfers who have used 3rd-party providers in the past 12 months said they played more rounds than they otherwise would have. Additionally, roughly half reported playing courses that they likely would not have patronized had it not been for the 3rd-party reseller(s) that they use.

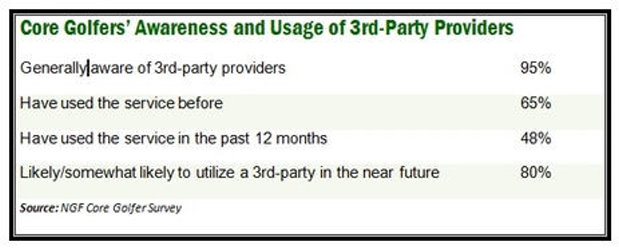

Golfers playing more rounds and expanding their selection of courses are results that most would agree are good for the industry. Awareness of the sites is nearly 95%; nearly half of core golfers report using a 3rd-party provider in the past 12 months, and 8 out of 10 say they’ll be utilizing the services in the near future. Still, the rise of tee time resellers is often credited (translation: blamed) for price compression. Others reasonably contend that the most powerful force affecting price is the relationship between supply and demand. That makes sense given that only one-third of all tee times booked by core golfers are done so via the Internet, with 3rd-party bookings estimated to account for half of those.

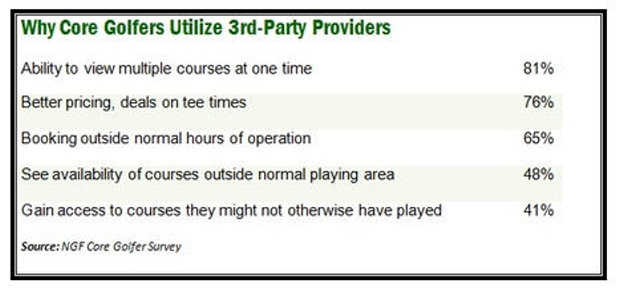

‘Deal hunting’ is a significant consumer motivator in the use of 3rd-party sites. Roughly three out of every four core golfers told us they use the sites to search for discounts, and nearly one-third said it was the primary reason. Still, it’s not all about price. Seventy percent of core golfers said they remained selective about the courses they play even when using tee time resellers.

The appeal of 3rd-party sites among budget-conscious golfers is similar to what we witnessed in the travel industry years ago with the emergence of platforms such as Expedia.com and Travelocity.com. While the early years had operators and the sites in adversarial positions, the relationship between hotel chains and inventory resellers eventually evolved into a more collaborative partnership. Discount seekers are served through 3rd-party travel sites’ aggregation of distressed inventory, while pricing during peak travel periods is protected for the less price-centric customers. A similar evolution has emerged in golf as the ongoing push and pull among course operators and 3rd-party tee time providers has inspired more attention and resources directed toward yield management and dynamic pricing that will benefit the industry long-term. Careful management of inventory and all tee-time inventory booking channels is key.

“My feeling is that the industry is moving, very cooperatively, in the right direction,” Peter Hill, CEO of Billy Casper Golf, recently told the Wall Street Journal. “The 3rd-party resellers are adjusting to reality. Nobody wants to drive prices so low they are unsustainable. That’s like eating your young.”

So what motivates those who aren’t discount shopping to still utilize 3rd-party tee time providers? Well, nearly 80% of core golfers told us they preferred the convenience of viewing multiple courses and various tee time options at one time, similar to the way consumers use platforms such as Kayak.com and Hotels.com to buy a hotel room or book an airline seat. Nearly half use tee time resellers to research and book rounds when traveling away from their home courses. In fact, 47% are more likely to book travel rounds through a third party than they are to book tee times at a course in their own backyard using the service. Another driver of 3rd-party usage is the ability to reserve tee times outside of the normal hours of operation, a reminder of the 24/7 digital world we live in.

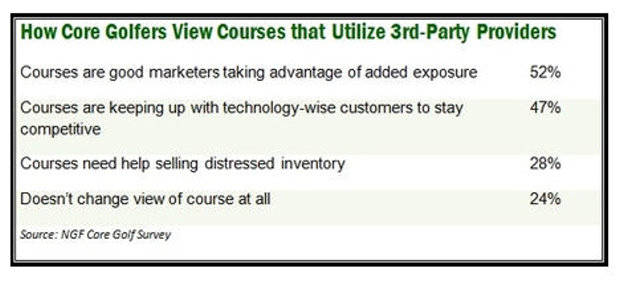

How Do Core Golfers View Courses They Find on 3rd-Party Tee Time sites?

We also asked core golfers what they thought about the courses they found on the sites. What we learned may surprise even the most entrenched and engaged stakeholders.

More than half of core golfers view courses that utilize 3rd-party providers as smart marketers. Likewise, nearly half consider these courses to be technology savvy and responsive to the changing behavior of their customers.

So what does all this mean for the future of 3rd-party providers? Do resellers have more upside potential or are they close to reaching a plateau? One point of view is that tee time booking fees charged by many resellers will limit their growth. Others say it’s simply easier to book directly with the golf course. ‘Why would I pay a fee to book at any of the three or four courses I regularly play? I already have them on speed dial and their tee sheets bookmarked.’ Conversely, nearly 80% of core golfers say they are very or somewhat likely (one-third are very likely) to book with a 3rd-party site in the near future, and almost half of those who have booked previously said they weren’t concerned about paying the booking fees.

Many points will continue to be argued, yet most would agree that the future trajectory of tee time resellers will be determined by golfers themselves.

NGF (National Golf Foundation) www.ngf.org

Read more stories about Golf Management Topics and latest list of Most-read stories